Last week the US Dollar ended the weeks the best performing. This is against a backdrop of an expected 25bps rate cut in December.

A surge in US Treasury yields took the dollar higher as inflationary data showed a persistent higher level of inflation.

The new administration takes office in January and the impact of their fiscal and trade policies are still unknown which is keeping the Dollar inflated currently.

Across the risk related currencies AUD was one of the winners as it fell less vs a strong and dominant Dollar. Strong employment numbers released has shifted expectations of Q1 rate cuts from the RBA. CAD also made the news as the RBA cut rates by 50bps but forward guidance a more measured approach giving the signal that more central banks are looking at the data going forward.

Both GBP and EUR ended the week in the middle of their respective ranges on the week. Euro lost ground vs the Dollar post ECB but with little new news the markets both ended on a quieter note.

Oil bounced back from the support levels we witnessed last week rallying 6% to close around $71.

The week we should see the last changes before the market goes into holiday mode. The Fed rate cut is expected to deliver a 25bps cut ad we also have rate decisions from BoJ, and Boe.

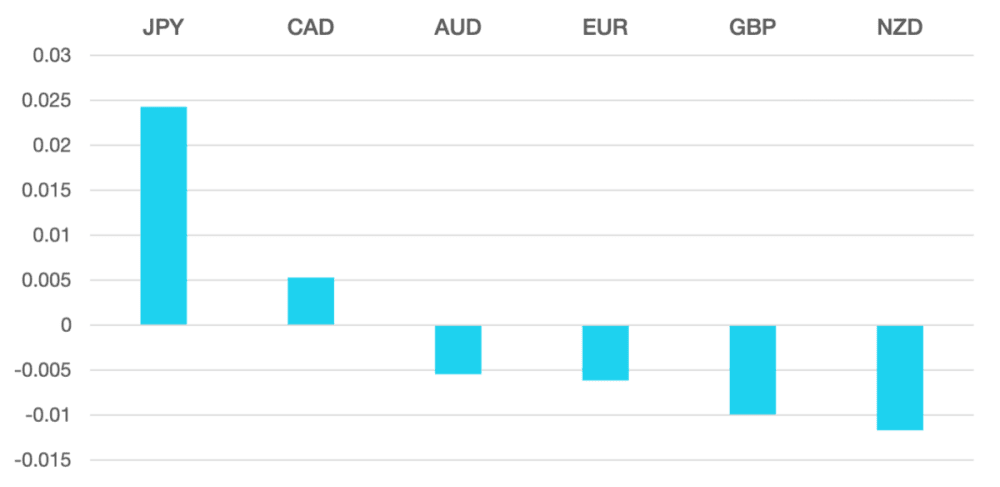

Weekly Majors’ Market Performance

What is Cromwell FX?

Cromwell FX is a quantitative FX manager offering superior risk adjusted returns. The portfolio is the most liquid pairs. The strategy is fully automated and adhere to strict rick management procedures to control leverage and position limits.

The post Dollar Rise Continues first appeared on trademakers.

The post Dollar Rise Continues first appeared on JP Fund Services.

The post Dollar Rise Continues appeared first on JP Fund Services.